How to Build a Business Credit Score for Your Small Business

Running a successful business requires a multitude of skills and strategies. One often overlooked aspect is maintaining good business credit relationships with your vendors and your partners to build and protect your credit profile. Your business's credit profile is a reflection of your company's financial health, and it plays a crucial role in obtaining funds from lenders to fuel your growth and expansion or simply tide you over in tougher times. In this article, we will explore the importance of business credit and the key steps to maintaining a good credit reputation. We'll also introduce you to Thriday, a next-generation all-in-one financial management that can help simplify and automate the process so you can reap the long-term benefits of keeping your business credit in top shape.

Understanding the Importance of Building Business Credit for Your Small Business

In Australia, while there isn't a single uniform credit score for businesses, building and maintaining your company's creditworthiness is still extremely worthwhile. Cultivating a strong credit profile for your business can unlock a multitude of benefits, including:

- Enhanced Loan Opportunities: A commendable credit profile positions your business as a lower-risk candidate, improving your chances of loan approval. Expect more generous credit offers with favourable repayment schedules and reduced interest rates.

- Elevated Credit Ceilings: A robust credit reputation often translates to expanded credit limits, giving your business the financial headroom to pursue growth and expansion initiatives.

- Facilitation of Business Growth: With a solid credit profile, your business gains access to the necessary capital for scaling operations, whether investing in new technology, bolstering your workforce, or branching out to new locations to swiftly seize those windows of opportunity.

- Bolstered Business Reputation: Maintaining good business credit creates a positive perception of your company's reliability and financial stability, enhancing your standing with suppliers, creditors, and potential partners. This reputation not only attracts potential customers and partners but also increases your business's value should you decide to sell or seek investment.

- Preferential Supplier Terms: Suppliers are more inclined to offer favourable terms, such as longer payment windows or discounts on goods and services, to businesses with a proven credit track record. These improved terms can positively impact your cash flow, allowing for better financial management and increased profitability.

- Rewards and Incentives: Leveraging business credit cards with a responsible approach can yield rewards and incentives, such as cashback offers and travel perks, while simultaneously fortifying your business credit standing for future financial endeavours.

Considering this, your reputation for paying on time and managing debts can make or break business relationships and opportunities.

A spotless credit profile is more than a badge of honour; it's a strategic tool that can facilitate financing, enhance payment conditions, draw investors, and safeguard both your business's and your personal financial integrity. To preserve an admirable credit profile, prioritise punctual bill payments, manage debt judiciously, and be measured and mindful of frequent new credit inquiries.

With the ability to easily automate your accounts payable, instant invoicing processes and the rest of your banking and accounting in one simple integrated platform, Thriday makes staying ahead of your bills and payments to build credit with suppliers and lenders a breeze.

Key Elements of Your Business Credit Profile

Building and maintaining a comprehensive business credit profile in Australia involves several critical elements:

- Financial Statements Analysis: Your business's financial statements, such as income statements, balance sheets, and cash flow statements, are scrutinised by lenders to determine your fiscal strength and loan repayment capabilities. With Thriday's automated accounting, generation of these key financial statement is done for you automatically in the platform using your integrated transaction data - meaning all your key reports are always available and automatically up-to-date when application time comes.

- Credit Score Assessment: A business credit score is a number crafted by credit reporting agencies to measure your ability to manage and repay financial obligations – based on your business's financial history and behaviours and ultimately reflecting your small business's financial health. When you apply for credit, banks and lenders will often consider your credit score along with your earnings, collateral and duration of operations to evaluate the risk involved in extending financial support to your enterprise.

- Detailed Credit Report: Beyond the score, your credit report offers an in-depth look at your business's financial narrative, spotlighting any instances of defaults, delayed payments, or other financial blemishes that could influence a lender's decision.

- Collateral Valuation: For secured loans, the collateral you propose—be it real estate, vehicles, or equipment—is appraised to ensure it meets the lender's requirements and aligns with the loan amount sought.

- Business Plan Evaluation: A well-crafted business plan can be instrumental in lending decisions, providing lenders with insight into your business model, market positioning, and growth projections.

To foster a robust credit profile, it's essential to manage your finances diligently—this means maintaining a commendable credit score, ensuring timely bill settlements, and keeping debt levels in check. Regular monitoring of your holistic business credit profile is advisable to detect any potential issues early and to strategise effectively to enhance your credit standing.

How Are Business Credit Scores Calculated?

Different credit reporting agencies in Australia, such as Equifax and Experian, generate different credit scores, each with proprietary and, at times, mysterious methodologies. As a result, your business will have multiple credit scores, and the precise formula for each may not be transparent. Nevertheless, there are some common factors considered across all credit scoring systems.

- Credit scoring entities often have ties to debt collection agencies, which provides them insight into which businesses are fulfilling their financial obligations.

- They compile information that is publicly accessible from government entities such as ASIC, PPSR and financial institutions regarding your business.

- Your payment practices could be reported to a credit scoring agency by those dissatisfied with your payment timeliness, such as vendors and partners.

- A large number of previous applications for credit may be penalised in your credit score as it can signal a high level of credit dependence and risk.

Each agency has scores that range on different scales, but the commonality between them is that higher scores indicate better payment performance and can help unlock the world of opportunity that comes from well-maintained business credit.

Does My Personal Credit Affect My Business Credit?

Business credit history is not the same as personal credit history, yet for small businesses, the lines can often be blurred. If your business lacks a substantial credit history, lenders might look to the personal credit history of you as the business owner as a proxy for the business's creditworthiness. This is particularly true for new startups, smaller ventures and sole trader operators.

Over time, as a business matures and establishes its own credit history, the reliance on the owner's personal credit may diminish. Nonetheless, the echoes of personal credit history can persist. For example, if a business owner has experienced personal bankruptcy, it could negatively reflect on the business's ability to secure credit. Therefore, while building a solid business credit resume is essential, the role of personal credit cannot be ignored, underscoring the need for business owners to diligently manage both personal and business credit profiles.

Managing Your Business Credit with Thriday

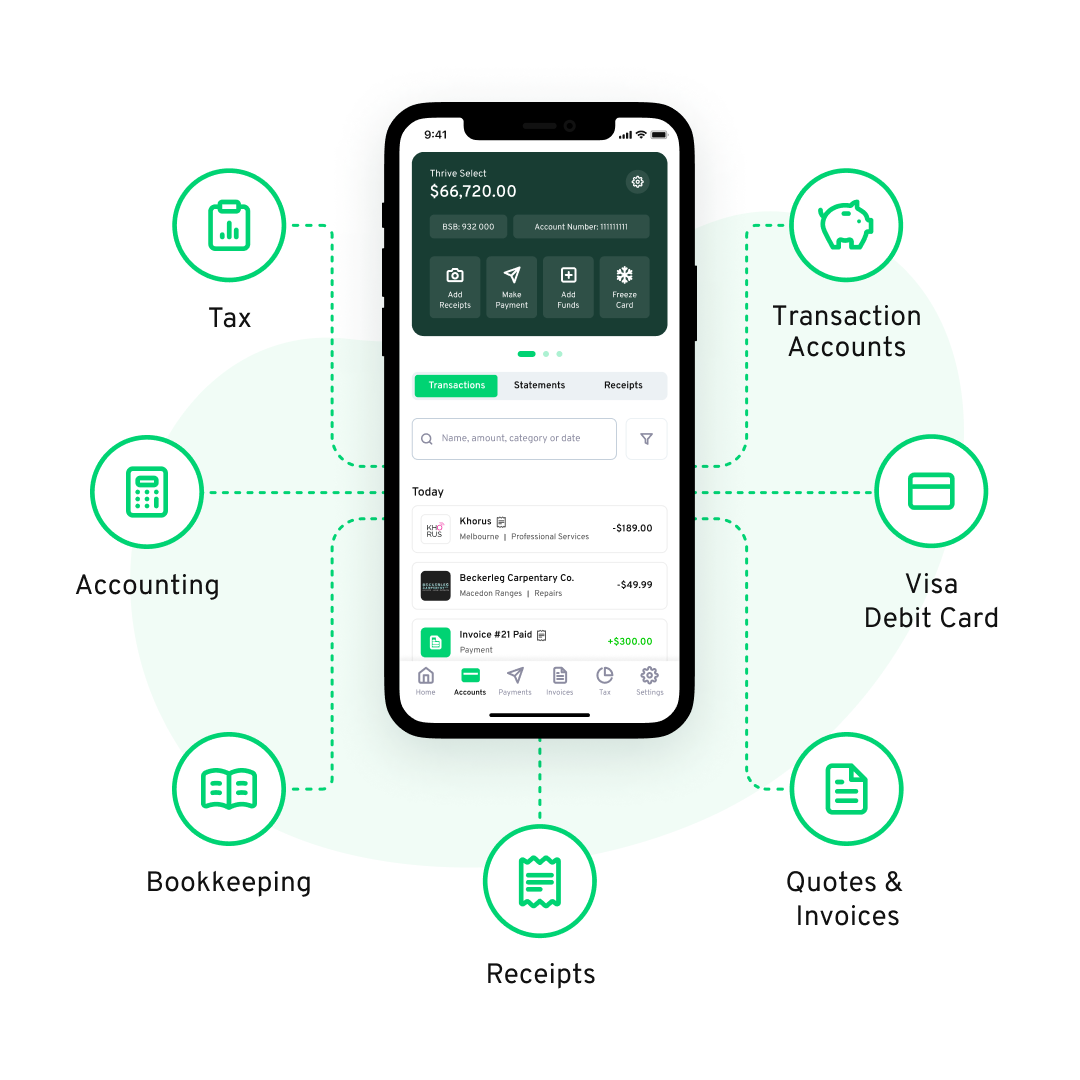

With the right tools, managing your business credit effectively becomes significantly easier. That's where Thriday comes in. Carefully developed to help small business owners in Australia thrive on all financial fronts, Thriday is an all-in-one financial management platform that automates and eliminates the complexities of financial admin.

With business banking* and accounting seamlessly integrated into one platform, your income and expenses are automatically tracked and categorised with the power of AI into financial reports such as cash flow projections, tax estimates and much more to give you a clear and complete picture of your business's finances in real-time.

Adding the power to automate accounts payable with Bill Manager to effortlessly stay ahead of payments and invoice instantly to improve billing processes in one simple user-friendly platform integrated with the rest of your banking and accounting - Thriday simplifies the financial admin that underpins a robust business credit score, making access to better loan terms to fuel growth or funds to tide you over in turbulent times more attainable.

As a platform, Thriday can help with the timely management of obligations to improve your business credit and free you from manual tracking and calculations. By automating these processes, Thriday allows you to focus on the strategic aspects of your business while effortlessly maintaining a strong business credit profile.

Steps to Maintain a Good Business Credit Profile

Now that we understand the significance of business credit and its makeup, let's explore the key steps you can start taking today to build it. By proactively following these steps, you can establish a solid credit foundation and increase your chances of securing favourable financing options when needed.

Timely Payments and Your Credit Profile

Consistently paying your bills on time is THE key way to demonstrate your ability to manage financial obligations responsibly. Late or missed payments can have a negative impact on your credit profile as unhappy vendors and partners can report you and leave blemishes on the records reporting agencies gather information from to assign your score. Prioritising timely payments to suppliers, lenders, and other parties is essential to maintaining a positive credit history.

In addition to maintaining a positive credit history, making timely payments also helps build trust and strong relationships with your suppliers and lenders. When you consistently meet your financial obligations, it shows that you are reliable and trustworthy, which can open up opportunities for better credit terms and conditions for future credit agreements.

With Thriday, you can easily automate the scheduling and payment of your bills in the same simple user-friendly platform that manages all your other business banking* and accounting needs. Learn more about bill manager here to make late and missed payments a distant memory!

Managing Your Business's Financial Health

Lenders and creditors often assess your company's financial health when evaluating your creditworthiness. By maintaining positive cash flow, a strong balance sheet, and healthy profit margins, you can demonstrate financial stability, positively impacting your business credit profile. Prioritise sound financial management practices to keep your company in good standing.

With Thriday's automated accounting, you can effortlessly stay on top of these critical financial metrics. The platform leverages the power of AI to categorise all your transactions and automatically generate the full suite of financial reports you need for your business. Balance Sheet, Income and Cash Flow statements, tax estimates and much more are all created for you and updated in real-time as transactions happen – empowering you to make data-driven decisions and maintain financial health effortlessly.

Maintaining a strong financial position also enables you to protect and invest in your business's future. Whether it's upgrading equipment, expanding your product line, hiring additional staff or just making sure that your business can operate sustainably as is – having the clarity on your business' standing and financial health provided by Thriday to support these initiatives can propel your business forward and give you that competitive edge in today's demanding market.

Regularly Monitoring Your Credit Score

Regularly reviewing your business credit score with credit reporting agencies to see what your lenders and suppliers see allows you to promptly detect and address any inaccuracies. Disputing inaccurate information and ensuring that your credit reports are up to date helps maintain an accurate representation of your creditworthiness.

Other factors influencing your business credit score include public records, such as bankruptcies or liens, and the number of credit inquiries made on your business – recognising these factors and actively managing your business credit is the key to maintaining a strong credit profile and unlocking opportunities for growth and success.

Keeping Your Personal and Business Finances Separate

Segregating your personal and business finances not only enables accurate financial record-keeping but also protects your business funds and credit from potential personal liabilities. Maintaining separate bank accounts, debit cards, and financial statements ensures a clear distinction between personal and business finances.

With Thriday, you can have your financial record-keeping automated and effortlessly manage up to 9 business bank accounts with a VISA debit card* in one simple, user-friendly platform. This allows you to keep your finances neatly organised and separate, making it easier to maintain a clear financial boundary between your personal and business worlds. You can learn more about the importance of separating business and personal finances here.

Harnessing Thriday for Long-Term Business Credit Excellence

As we've explored, maintaining good business credit can have significant benefits that stretch beyond even your immediate financing needs by contributing to both your business's success and reputation in the long-term.

By understanding the importance of business credit, using the right tools to monitor and manage the key factors that influence it, and taking the right steps early to maintain a positive credit profile you can position your business in the best way possible.

With Thriday, supercharged with real-time automated financial reporting, payment scheduling, invoicing and much more in one platform that seamlessly integrates business banking* and accounting, you can effortlessly monitor and improve the key financial processes and metrics that influence your business credit.

By automating and eliminating the typical time and headache required to keep up with financial admin, Thriday helps you maintain a stellar credit history with ease - enhancing your appeal to lenders and investors and positioning you for favourable terms with suppliers while you focus on taking care of business.

Take the proactive approach and start with Thriday today to set the stage for long-term growth, stability, and success!

DISCLAIMER: Team Thrive Pty Ltd ABN 15 637 676 496 (Thriday) is an authorised representative (No.1297601) of Regional Australia Bank ABN 21 087 650 360 AFSL 241167 (Regional Australia Bank). Regional Australia Bank is the issuer of the transaction account and debit card available through Thriday. Any information provided by Thriday is general in nature and does not take into account your personal situation. You should consider whether Thriday is appropriate for you. Team Thrive No 2 Pty Ltd ABN 26 677 263 606 (Thriday Accounting) is a Registered Tax Agent (No.26262416).

.svg)

%20(1).jpg)

.webp)