AASB, IFRS or GAAP? Understanding Australian Accounting Standards

For small business owners in Australia, understanding and adhering to accounting standards like the AASB, IFRS & GAAP can feel like a headache of acronyms and complex financial admin, but no longer! In this in-depth guide, we'll delve into the basics of these accounting standards, explore their significance for small businesses in Australia, and reveal how Thriday can transform the way you manage your business finances in compliance with these essential guidelines.

In the world of business finance, accounting standards like the Australian Accounting Standards Board (AASB), International Financial Reporting Standards (IFRS), and Generally Accepted Accounting Principles (GAAP) play a pivotal role. These standards are more than just a collection of complex rules; they are the foundation of financial transparency and consistency across the global business landscape.

Understanding Australian Accounting Standards

In the Australian context, the guidelines developed and maintained by the Australian Accounting Standards Board (AASB) are the critical standards you need to keep in mind to stay compliant when preparing your key financial statements.

What is the Australian Accounting Standards Board?

The Australian Accounting Standards Board (AASB) is the Australian Government agency responsible for developing and maintaining the set of financial reporting standards that apply to entities in the private and public sectors of the Australian economy.

The Australian accounting standards are a framework established by the AASB for the preparation and presentation of financial statements - similar to those outlined by the International Financial Reporting Standards (IFRS) but specialised and adapted to be the Australia-specific equivalents that ensure that financial statements are transparent, comparable, and consistent across different businesses.

Carefully developed with reference to Australian accounting principles, Thriday aims to simplify financial reporting for local small businesses. By automating the creation of financial reports, Thriday takes the guesswork and complexity out of financial statement preparation and compliance.

Why are these standards important?

For Australian small businesses, adhering to AASB standards is crucial. It ensures that their financial statements are prepared according to a recognised framework, facilitating trust among investors, lenders, and other stakeholders. Here's why these standards matter:

- Transparency: These standards ensure that financial information is presented clearly and transparently, making it easier for stakeholders to understand a company's financial position.

- Comparability: Standardised accounting practices allow for the comparison of financial statements of different companies, which is crucial for investors and analysts.

- Reliability: Adherence to these standards means that the financial data presented is reliable and prepared following recognised guidelines.

- Compliance: For businesses, compliance with these standards is often legally required, especially for tax purposes and non-compliance can lead to penalties and loss of credibility.

International Standards

Outside of Australia, two major sets of accounting standards dominate -the International Financial Reporting Standards (IFRS) and the Generally Accepted Accounting Principles (GAAP).

While the AASB standards are pivotal for Australian entities, understanding IFRS and GAAP is essential for businesses operating internationally or dealing with foreign investors.

International Financial Reporting Standards (IFRS)

The IFRS is a set of international accounting standards stating how certain types of transactions and other events should be reported in financial statements. They are also designed to bring consistency, transparency, and efficiency to international financial markets.

Key Features:

- Global Standard: IFRS is used in over 140 countries, making it the most widely adopted global accounting standard.

- Uniformity: Much like the AASB, its aim is to make financial statements comparable and understandable across international boundaries.

- Flexibility: IFRS tends to be more principles-based and less prescriptive than GAAP, allowing for more judgment and interpretation in their application.

You can learn more about the IFRS here.

Generally Accepted Accounting Principles (GAAP)

GAAP refers to a common set of accounting principles, standards, and procedures that companies must follow when they compile their financial statements. It is primarily used in the United States.

Key Features:

- Country-Specific: Unlike IFRS, GAAP is not universally adopted and is specific to the U.S. financial reporting framework.

- Detail-Oriented: GAAP is known for its detailed rules and specific guidelines, making it more rules-based compared to the principles-based approach of IFRS.

- Industry-Specific Guidance: GAAP often provides detailed guidance for specific industries, something less common in IFRS.

Differences from AASB Standards

While AASB standards align closely with IFRS, there are nuanced differences between them and GAAP. Here are some key distinctions:

- Conceptual Approach: AASB and IFRS are more principles-based, focusing on the substance of transactions. In contrast, GAAP is more rules-based, emphasising the form of transactions.

- Flexibility vs. Specificity: AASB and IFRS offer more flexibility and require professional judgment, whereas GAAP provides detailed instructions, reducing the need for interpretation.

- Adoption and Scope: AASB is specific to Australia, IFRS has a broader international scope, and GAAP is primarily U.S.-centric.

If your business operates solely in Australia, then AASB is the only framework that you need to work within; however, understanding these differences is crucial if your small business has international dealings or aspirations, ensuring not only compliance with local standards but also preparing your business for global interactions.

Simplifying Compliance with Thriday

With the development of next-generation financial management platforms, gone are the days when adhering to the AASB guidelines in bookkeeping and accounting was a daunting task that stole the downtime of small business owners everywhere.

Compliance with these standards, while crucial for accuracy and transparency, is used to demand extensive time and expertise, especially when dealing with various bank feeds, platforms, software and reporting obligations.

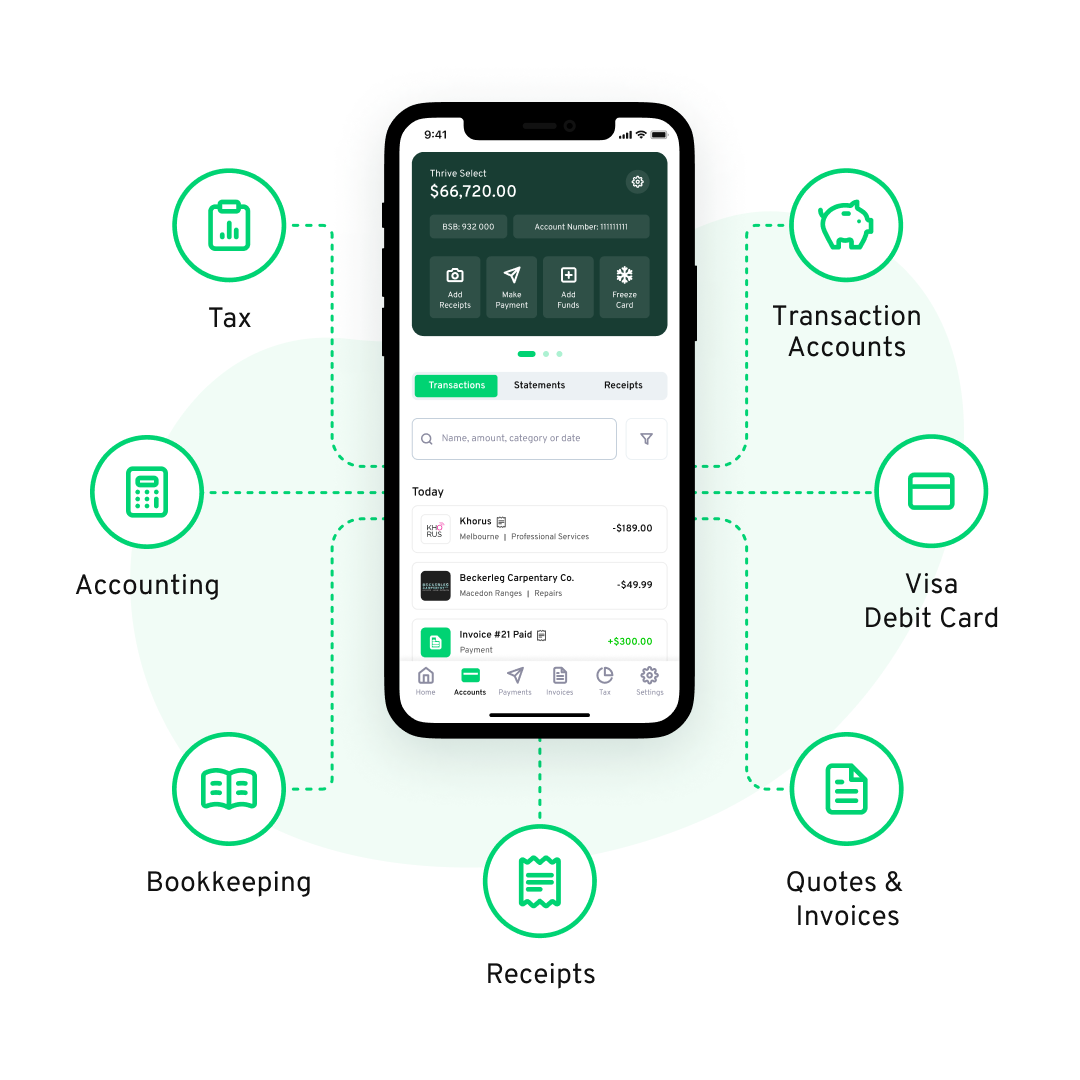

Enter Thriday: a ground-breaking app that combines your business banking* and accounting into a simple all-in-one financial management platform that automates and eliminates financial admin – rescuing small business owners from the headache of manual bookkeeping, reconciliation and financial statement creation.

Carefully designed with the specific needs of Australian small businesses in mind and with AASB guidelines in mind, Thriday seamlessly integrates with your business banking* and invoicing, employing advanced AI technology to automatically sort and categorise your transactions, handling all your bookkeeping needs and generating a full suite of key financial statements - constantly updated with each transaction, offering a real-time snapshot of your financial status.

How does Thriday work?

With built-in business transaction accounts* and a VISA debit card, Thriday is an all-in-one financial management platform that integrates banking* and accounting into a single, efficient platform to automate bookkeeping, accounting, and financial reporting - simplifying financial processes and eliminating the need for financial admin.

Far from being just another accounting software, Thriday is transformative for business owners aiming to streamline their financial operations and reclaim their time. Here's how it works:

- Seamless Banking* Integration: Thriday's user-friendly app integrates business transaction accounts*, automating the synchronisation of all financial transactions. This seamless integration eliminates the need for separate bank feeds and manual data entry, simplifying your financial management. You can learn more about Tireless Transacting here.

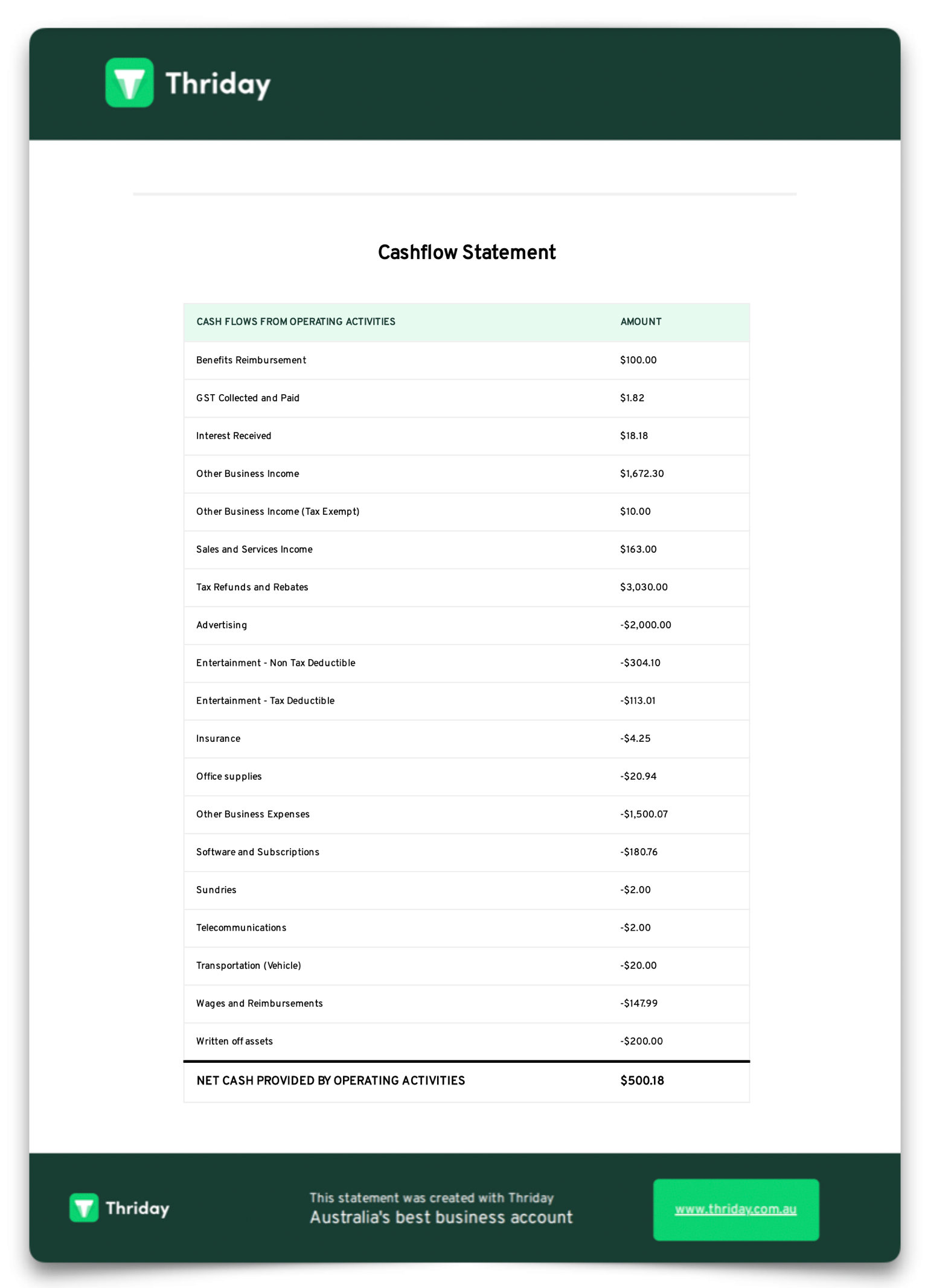

- Automated Accounting: Thriday consolidates your financial transactions on a single platform, employing AI for automatic reconciliation and categorisation. This leads to the automatic generation of essential accounting reports for small businesses. Access up-to-date financial statements like cash flow, income statements, and balance sheets effortlessly, allowing you to focus more on your passion and less on tedious manual admin.

- Receipt Reconciliation: Thriday simplifies receipt management. Just snap a photo of your receipts, and the platform will automatically store and reconcile them, incorporating them into tax estimates and financial reporting as well as keeping them easily accessible come tax time. This feature is invaluable for small businesses to efficiently track expenses and deductions.

Simply use Thriday's integrated business transaction accounts* for your day-to-day business transactions, and the platform will take care of the rest!

From here, the platform leverages the power of AI to automatically reconcile your transactions and prepare your full suite of financial reports, freeing you from the burden of financial admin so you can get back to what's important – running your business.

Key Takeaways: Eliminating Financial Complexity with Thriday

In wrapping up our exploration of AASB, IFRS, GAAP and innovative new financial management software - it's evident that Thriday is revolutionising financial management for Australian small businesses. Simplifying the messy world of accounting standards and report preparation, Thriday offers a seamless integration of banking* and accounting in one user-friendly application.

Eliminating the need for manual data entry and easing the burden of complex financial reporting requirements; Use Thriday to say goodbye to the hassle of manual sorting, the complexities of financial statement preparation, and those long Sunday nights trying to reconcile accounts.

Let Thriday's AI-driven technology automate tedious financial tasks, from transaction categorisation to real-time financial reporting, to help ensure compliance with accounting standards and provide you with a clear and always up-to-date view of your business's financial health.

DISCLAIMER: Team Thrive Pty Ltd ABN 15 637 676 496 (Thriday) is an authorised representative (No.1297601) of Regional Australia Bank ABN 21 087 650 360 AFSL 241167 (Regional Australia Bank). Regional Australia Bank is the issuer of the transaction account and debit card available through Thriday. Any information provided by Thriday is general in nature and does not take into account your personal situation. You should consider whether Thriday is appropriate for you. Team Thrive No 2 Pty Ltd ABN 26 677 263 606 (Thriday Accounting) is a Registered Tax Agent (No.26262416).

.svg)

%20(1).jpg)

.avif)

.webp)